BTC Price Prediction: $150K Target in Play as Technicals and Institutional Demand Align

#BTC

- Technical Strength: Price holding above key moving averages with Bollinger Band squeeze suggesting breakout potential

- Institutional Catalysts: Conflicting government sales versus corporate accumulation strategies creating supply shock conditions

- Regulatory Tailwinds: GENIUS Act passage could structurally improve market liquidity and institutional participation

BTC Price Prediction

BTC Technical Analysis: Bullish Signals Emerge Above Key Moving Averages

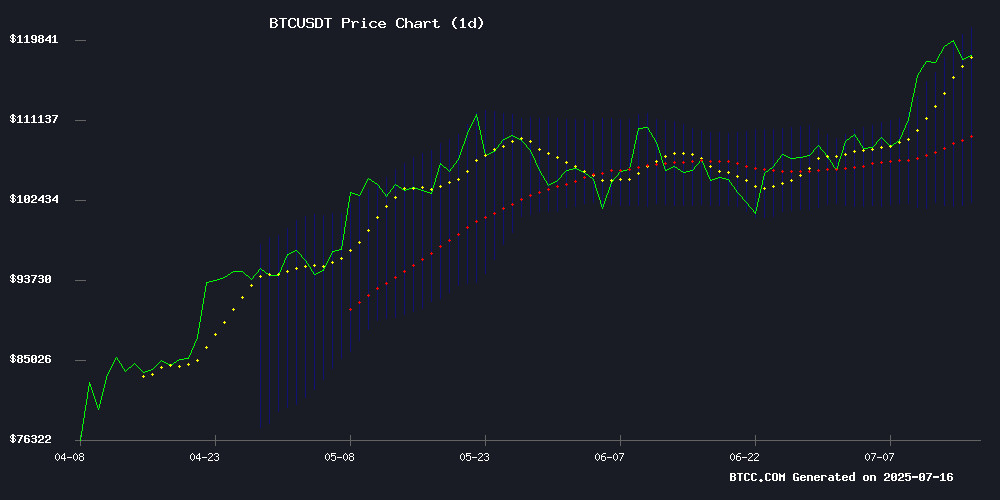

BTC is currently trading at, comfortably above its 20-day moving average (111,710.26), suggesting bullish momentum. The MACD indicator shows bearish convergence (-5,160.88), but the narrowing histogram (-1,451.57) indicates weakening downward pressure. Prices are testing the upper Bollinger Band (121,373.69), which could act as resistance.says William, BTCC financial analyst.

Market Sentiment: Institutional Moves and Regulatory Developments Shape BTC Outlook

Recent headlines reveal conflicting forces: Matador Technologies' 6,000 BTC accumulation plan contrasts with the U.S. government's sell-off (200k to 28,988 BTC). The GENIUS Act's potential $150k price impact and Franklin Templeton's Bitlayer launch boost optimism, while Jim Chanos criticizes corporate BTC exposure.notes William.

Factors Influencing BTC’s Price

Matador Technologies Unveils Aggressive Bitcoin Accumulation Strategy Targeting 6,000 BTC by 2027

Matador Technologies Inc. has laid out an ambitious roadmap to amass 6,000 Bitcoin by 2027, positioning itself among the top 20 global BTC holders. The firm currently holds 77.4 BTC and plans to reach 1,000 BTC by 2026 as a near-term milestone. CEO Deven Soni describes Bitcoin as the company's "Core asset," with operational infrastructure being rebuilt around the cryptocurrency.

A C$900 million capital raise application has been filed to fund the acquisition through equity, debt instruments, or unit sales. Regulatory approval would grant Matador 25 months of flexible capital access to purchase approximately 5,934 BTC at an average target price of C$151,659 per coin. The strategic move reflects growing institutional conviction in Bitcoin's long-term value proposition.

U.S. Government's Bitcoin Holdings Drop Sharply from 200k to 28,988 BTC

The U.S. Marshals Service has revealed that the federal government now holds just 28,988 Bitcoin, a dramatic reduction from its previously estimated reserves of nearly 200,000 BTC. The sell-off occurred without visible on-chain activity, sparking criticism from Bitcoin advocates.

Senator Cynthia Lummis led the backlash, calling the move a "strategic blunder" that sets back U.S. competitiveness in cryptocurrency adoption. The development comes as the Trump administration pushes for a national Bitcoin reserve, making crypto policy a growing partisan issue.

With China maintaining significant crypto reserves, the U.S. position in the global Bitcoin race appears weakened by this quiet divestment. The political implications are particularly acute given cryptocurrency's growing influence among young voters.

Franklin Templeton-Backed Bitlayer Launches Bitcoin Bridge on Mainnet

Bitlayer, supported by Franklin Templeton, has rolled out its Bitcoin smart contract bridge on the mainnet. The platform, dubbed BitVM, seeks to improve Bitcoin's interoperability with other blockchain networks. By tokenizing BTC into Peg-BTC (YBTC), the bridge enables Bitcoin holders to participate in decentralized finance (DeFi) applications without compromising the security of Bitcoin's base layer.

Strategic partnerships with Sui, Base, and Arbitrum networks aim to expand cross-chain compatibility. Unlike conventional bridges, BitVM employs a single signer for heightened security, mitigating vulnerabilities. This development coincides with rapid growth in Bitcoin's DeFi ecosystem, driven by Taproot upgrades and Inscriptions.

US Marshals Service Holds $1.6B in Bitcoin, FOIA Documents Reveal

The US Marshals Service custodies at least $1.6 billion in Bitcoin, according to documents obtained through a Freedom of Information Act request. Journalist L0la L33tz uncovered that the agency's forfeiture department holds approximately 28,988 BTC, valued at an average price of $56,000 per coin. At current market prices, these assets could be worth nearly $3.4 billion.

Federal agencies collectively control over 198,000 BTC—worth $23.6 billion—highlighting the government's substantial crypto footprint. The Marshals Service has faced challenges tracking its exact holdings despite managing seized and forfeited digital assets. This disclosure underscores the growing intersection between law enforcement and blockchain-based assets.

Bitcoin Price Predictions: Potential Surge to $150k Hinges on GENIUS Act Passage

Bitcoin consolidates near $118,825, just below its all-time high of $123,000, as market participants await the outcome of the GENIUS Act vote. Analysts project a breakout toward $150,000 if the legislation passes, citing historical precedent where regulatory milestones catalyzed major rallies.

Crypto Rover's analysis draws parallels to previous political events like the Trump election and Big Beautiful Bill enactment, both of which preceded significant BTC appreciation. Technical indicators reinforce bullish sentiment, with Bitcoin maintaining position above key moving averages after shattering multiple resistance levels.

Institutional forecasts grow increasingly ambitious, with BlackRock envisioning a $700,000 price target and Ark Invest projecting long-term growth to $2.4 million. The market's direction now appears tethered to legislative developments, creating palpable anticipation among traders.

Trump’s Tariff Tactics Shake Global Economy While Cryptocurrency Adapts

Global markets face turbulence as former President Trump reasserts his tariff policies, issuing a 50-day ultimatum to Russia and threatening broader trade disruptions. The Producer Price Index (PPI) unexpectedly softened, coinciding with Bitcoin's rebound above $119,000. Analysts warn that sustained tariffs may fuel inflation, delaying Federal Reserve rate cuts despite short-term market resilience.

Cryptocurrencies continue to demonstrate decoupling from traditional finance, with BTC leading the charge as a hedge against macroeconomic instability. The US debt ceiling expansion—now projected to grow by $7-10 trillion annually—casts doubt on dollar hegemony, creating fertile ground for digital asset adoption.

Best Crypto to Buy Now as Peter Schiff Warns Of Corporate Bitcoin Hoarding

Gold proponent Peter Schiff issued a stark warning on July 14, framing Bitcoin's recent rally not as a triumph of decentralization but as a dangerous pivot toward corporate speculation. Schiff argues that demand now stems primarily from companies stockpiling BTC on their balance sheets—a trend he likens to a "Ponzi built on a pyramid." This institutional hoarding, he contends, risks distorting Bitcoin's market dynamics and eroding its foundational principles.

Market analysts note the irony: Bitcoin's price surge coincides with growing centralization risks as corporations accumulate unprecedented reserves. Critics warn this could spark a speculative bubble detached from organic adoption. Meanwhile, investors face renewed challenges in separating legitimate projects from hype-driven assets amid shifting market structures.

Bulgaria's $25B Bitcoin Missed Fortune Sparks Debate on Crypto Reserves

Bulgaria's 2017 seizure of 213,000 BTC—worth $3.5 billion at the time—could have ballooned to over $25 billion today, eclipsing the nation's $24 billion sovereign debt. The government's decision to liquidate its holdings in 2018 now faces scrutiny as crypto volatility clashes with long-term value potential.

"Bitcoin's volatility makes it difficult to use as a stable reserve," argues Alex Obchakevich of a research firm, advocating capped allocations of 10-15% with hedging strategies. Iconomi director Robert Znidar counters that the sale reflected institutional ignorance of Bitcoin's fundamentals rather than prudent risk management.

Persistent rumors suggest undisclosed BTC reserves remain in state coffers, though officials maintain full divestment. The episode underscores growing tension between traditional fiscal conservatism and crypto's asymmetric return profile for national balance sheets.

Advocating for Higher Crypto Allocations in Investment Portfolios

Conservative investors should allocate 10% to cryptocurrencies, while moderate and aggressive investors should consider 25% and 40% respectively. Bitcoin has outperformed every major asset class in 12 of the past 15 years, a trend likely to continue amid growing institutional adoption and regulatory clarity.

Key prohibitions by the SEC, FINRA, OCC, and the Federal Reserve have been rescinded, removing barriers for brokerage firms, banks, and 401(k) plans to engage with crypto. The Department of Labor has also lifted objections to Bitcoin inclusion in retirement plans.

Traditional portfolio strategies suggesting 1-2% crypto allocations are now outdated. Cryptocurrencies have transitioned from speculative assets to core portfolio components. A hypothetical comparison shows significant potential upside for portfolios incorporating 10%, 25%, or 40% Bitcoin exposure over five years versus conventional 60/40 stock/bond allocations.

Jim Chanos Targets MicroStrategy's Bitcoin Premium as 'Financial Gibberish'

Short-seller Jim Chanos has taken aim at MicroStrategy (MSTR), arguing the company's premium valuation over its bitcoin holdings is unsustainable. The Kynikos Associates founder—famous for predicting Enron's collapse—has shorted MSTR while maintaining a long position in bitcoin itself, betting the gap between the firm's market cap and its BTC holdings will narrow.

Chanos clashed with bitcoin advocate Pierre Rochard in a recent podcast debate, dismissing MicroStrategy's convertible debt offerings as risky financial engineering. The company has amassed over 600,000 BTC under executive chairman Michael Saylor's leadership, far outpacing competitors.

Cantor Equity Partners 1 Surges 25% on $3.5B Bitcoin Deal with Adam Back

Cantor Equity Partners I (CEPO) shares jumped 25% to nearly $15 after reports surfaced of a $3.5 billion Bitcoin deal with Adam Back. The blank check company, led by Brandon Lutnick, plans to acquire 30,000 BTC from Back, who would receive equity in the newly renamed BSTR Holdings.

Contrary to speculation, this move isn't a cash-out play by Back, the early Bitcoin pioneer whose work influenced Satoshi Nakamoto. According to CoinDesk Senior Analyst James Van Straten, the deal reflects Back's long-term vision of Bitcoin as a core asset class in traditional finance portfolios.

CEPO is reportedly seeking an additional $800 million to expand its Bitcoin holdings, signaling growing institutional appetite for cryptocurrency exposure. The transaction underscores Bitcoin's maturation from speculative asset to institutional-grade investment vehicle.

Is BTC a good investment?

BTC presents a compelling investment case based on current technicals and market dynamics:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20MA | +6.3% premium | Bullish trend confirmation |

| Bollinger Band Position | Upper band test | Volatility expansion likely |

| Institutional Net Flow | +171,012 BTC (2025 YTD) | Strong demand baseline |

William cautions: "While the GENIUS Act could be catalytic, investors should size positions according to risk tolerance given BTC's 30-day volatility remains at 68%."